One of the world’s largest companies, facilitating equitable access to home ownership and rental housing in America

A leading mortgage player and U.S. government-sponsored enterprise that delivers affordable home financing solutions to millions nationwide. Managing assets over $4 trillion, the company facilitates hundreds of thousands of mortgages, refinancings, and rental transactions each quarter.

Gain real-time visibility into business processes to detect issues early, optimize performance, and take faster decisions

The mortgage company was looking for a rule-based, data-driven BAM framework that would provide end-to-end visibility into its sprawling business processes — accelerating response time and enhancing decision-making. They wanted to:

Outdated monitoring systems and data quality gaps were hampering visibility and responsiveness.

Siloed monitoring systems

The use of fragmented systems for specific business units or lines of business (LOBs) was impacting process visibility and KPI monitoring.

Limited data processing capabilities

The existing system was not equipped to process large volumes of data from multiple sources in parallel, and in real time.

Lack of scalability

Their current multi-stage data collection and processing system was loosely coupled and based on discrete technologies in a Staged Event-Driven Architecture (SEDA), making it difficult to scale.

Data quality and reconciliation issues

The team was unable to detect anomalies and perform data quality checks and reconciliation in real time.

Implemented an end-to-end, high-performance solution for continuous business activity monitoring

Ready-to-use capabilities

Provided out-of-the-box capabilities for data ingestion, quality management, rule-based alerts, event correlation, schema detection, and more.

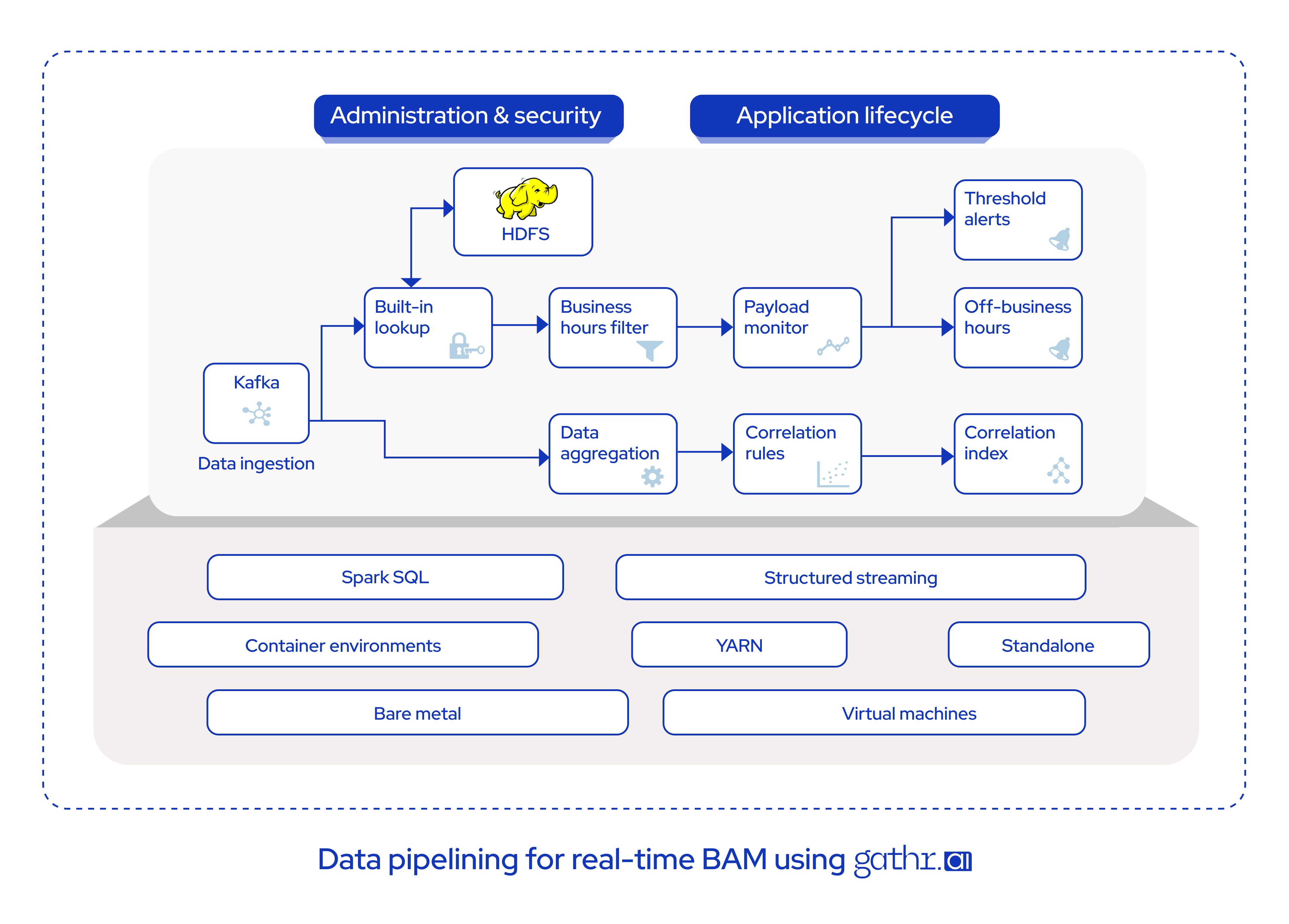

Simplified data pipelining

Helped seamlessly deploy and manage complex data pipelines on Apache Spark-based infrastructure.

Real-time alerts and SLA reporting

Created streaming and batch ETL pipelines for real-time alerting and historical data processing to generate SLA reports.

Real-time summary generation

Enabled real-time data summary generation at different levels (including historical data) and provided an aggregated view of these.

Streamlined data transformation

Provided 200+ operators for data wrangling and transformation with support for custom extensions and late data arrival.

Accelerated ETL

Enabled fast and efficient prototyping and deployment of ETL frameworks.

Comprehensive SLA monitoring solution

Delivered an end-to-end SLA solution with different modules for data ingestion, ETL, and real-time event processing and correlation.

Gathr.ai enabled the mortgage company to aggregate data from multiple sources, update rules without coding, and power real-time monitoring and data quality management. This, in turn, helped them efficiently track KPIs, correlate insights, reduce response time, and improve decision-making.

Implementing Gathr.ai has been a game-changer for us. It enabled us to track mission-critical KPIs efficiently, correlate data across systems, and gain real-time visibility across our business operations. This has helped us move from reactive problem-solving to proactive decision-making.

Director

Business Operations

Director

Business Operations

Implementing Gathr.ai has been a game-changer for us. It enabled us to track mission-critical KPIs efficiently, correlate data across systems, and gain real-time visibility across our business operations. This has helped us move from reactive problem-solving to proactive decision-making.

Redshift

Redshift MS SQL

MS SQL  MySQL

MySQL PostgreSQL

PostgreSQL Trino

Trino Starburst

Starburst

All resources

All resources