Summary

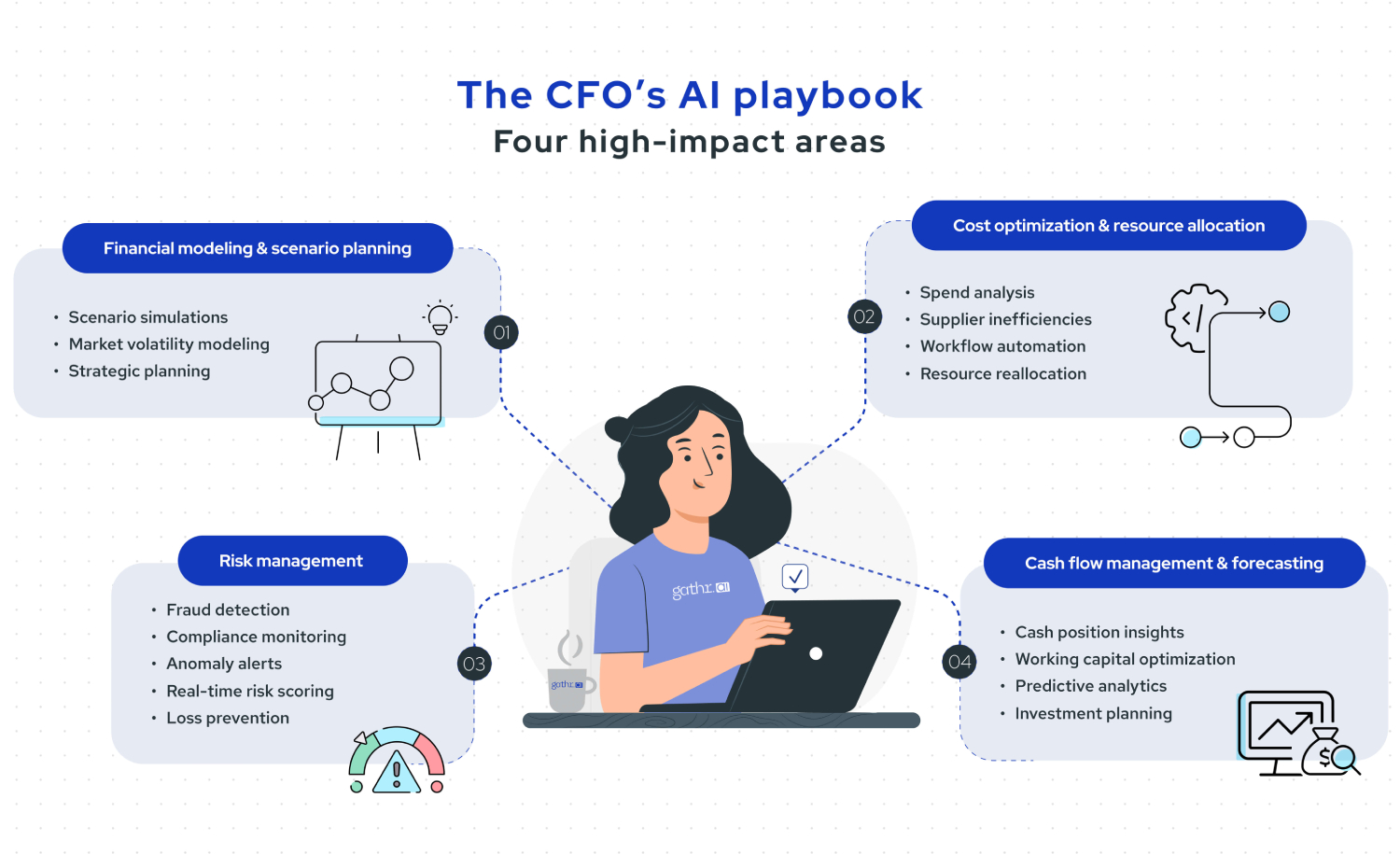

As AI adoption accelerates across industries, CFOs are uniquely positioned to leverage its transformative potential. Discover how AI is reshaping financial modeling, scenario planning, forecasting, risk management, cost optimization, resource allocation, and more.

AI’s influence on businesses has been steadily growing—and it’s only set to accelerate. As governments and technologists worldwide push the boundaries of AI at an unprecedented pace, discussions are heating up around how business leaders will harness this technology.

One of the leadership roles at the forefront of this conversation is that of the Chief Financial Officer (CFO). Finance is likely to be one of the domains most profoundly impacted by AI, along with key business functions like operations, customer support, sales, marketing and HR. Finance teams are turning to AI in every area of finance – from basic automation of accounting and tax operations to predictive modeling and risk management.

KPMG’s recent global AI in finance study reveals that 71% of companies are already using AI within finance operations, and over 80% find the ROI on using these technologies is meeting or exceeding expectations.*

This blog explores how AI can be a game-changer for CFOs, delving into the key areas of impact.

1. AI-driven financial modeling and scenario planning

One of the most significant ways AI is transforming the CFO’s role is through advanced financial modeling and scenario planning. Traditional financial models often rely on historical data and linear assumptions, which can fall short in today’s volatile and complex business environment.

AI can simplify financial planning by analyzing global market trends, geopolitical events, and internal financial data to simulate scenarios (like the impact of a trade war). This enables CFOs to move from reactive decision-making to proactive, data-driven strategy formulation, ensuring the organization is well prepared for future challenges and opportunities.

Example: Unilever uses AI to analyze weather patterns and accurately predict demand for ice-cream, while reducing wastage.

2. AI-powered risk management

Risk management has always been one of the most critical and difficult responsibility areas of for CFOs, who are expected to protect organizations against internal and external risks such as economic downturns, liquidity crunches, market disruptions, etc. However, traditional risk management methods that rely on structured frameworks, statistical models, and retrospective data often fail to deliver accurate results.

AI can help eliminate these challenges by tracking transactions and trends in real-time and flagging any kind of business or compliance related risks before they snowball. This in turn helps companies reduce potential losses and avoid reputational damage.

Example: BlackRock leverages AI to analyze thousands of call transcripts and broker reports to enhance data quality and analysis for risk management.

3. AI-driven cost optimization and resource allocation

AI can assist in cost optimization by analyzing spending patterns, identifying inefficiencies, and providing data-driven recommendations for cost reduction. AI can help CFOs assess procurement data to detect supplier inefficiencies, suggest cost-saving alternatives, and even predict potential price fluctuations. It can also analyze revenue streams, customer segments, and pricing strategies to optimize profitability.

Example: Amazon uses AI to optimize warehouse space, shorten delivery routes, and allocate inventory and human resources according to region and season-based demand.

4. AI-enhanced cash flow management and forecasting

Cash flow is the lifeblood of any organization, and CFOs are tasked with ensuring its stability. AI is revolutionizing cash flow management with real-time insights and predictive analytics. These trends help project future performing scenarios accurately, by smartly perusing cash flow patterns, historical datasets as well as external factors. Precise forecasting allows CFOs to make strategic changes in their investments, liquidity, debt management, and operational costs.

Example: Microsoft uses AI to predict cash inflows and outflows across its global operations.

Harnessing AI and data for an intelligent future

AI is more than just a tool for automation—it’s enabling leaders to double down their focus on strategy and innovation. For CFOs, this shift goes beyond streamlining processes to reimagining how financial strategy is built in the digital age. From automating routine reporting to unlocking powerful predictive insights, AI helps finance leaders navigate uncertainty, uncover new opportunities, and drive sustainable growth. With AI, CFOs can:

- Auto-generate financial statements, variance analysis, and compliance reports

- Enable smarter liquidity and investment planning by analyzing past trends, seasonality, and market variables

- Update sales, costs, and market changes automatically using real-time data

- Analyze procurement data to spot rogue spending as well as savings opportunities

- Continuously monitor credit, foreign exchange and market risk and deliver early-warning alerts

- Identify unusual patterns in transactions, reimbursements, or business-related expenses

- Auto-generate earnings call summaries, ESG reports, and investor briefs

- Map budgets and resources to business units for streamlining resource allocation

- Blend sales and CRM data with market trends to predict potential revenue streams

While AI promises transformative value in finance, its impact depends on the underlying data—and how well it understands it. Gathr.ai enables CFOs to unlock strategy-shaping intelligence—by exposing AI to complete data with full context.

For instance, they can get meaningful answers to high-stakes questions like ‘What’s the optimal capital allocation to increase profitability by X% without elevating risk?’, ‘What early signs indicate a potential liquidity crunch, and how can we combat this?, ‘Find hidden inefficiencies in our cost structure, and suggest how we can optimize the same?’ or ‘How will market shifts impact our cash flow in the next quarter and what adjustments can we make?’

This deep intelligence empowers them to become architects of business strategy, guiding their organizations in ways that once seemed out of reach. To learn more about Gathr.ai, schedule a demo today.

*Source: https://kpmg.com/xx/en/our-insights/ai-and-technology/kpmg-global-ai-in-finance-report.html

Redshift

Redshift MS SQL

MS SQL  MySQL

MySQL PostgreSQL

PostgreSQL Trino

Trino Starburst

Starburst

All resources

All resources